san antonio general sales tax rate

Download all Texas sales tax rates by zip code. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

. The portion of the sales tax rate collected by San Antonio is 125 percent. How do you figure out sales tax in San Antonio. The 78216 San Antonio Texas general sales tax rate is.

101 rows Texas San Antonio 78216. Every 2019 combined rates mentioned. The San Antonio Texas general sales tax rate is 625.

For a list of local tax rates see Texas Sales and Use. This is the total of state county and city sales tax rates. The average cumulative sales tax rate in San Antonio Texas is 822.

San Antonios fiscal 2021. What is the sales tax rate in San Antonio Texas. The December 2020 total local sales tax rate was also 63750.

The 78216 San Antonio Texas general sales tax rate is 825. While many other states allow counties and other localities. The sales tax jurisdiction.

There is no applicable county tax. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax. City of San Antonio Property Taxes are billed and collected by the Bexar County.

The San Antonio sales tax rate is 825. The December 2020 total local sales tax rate was also 8250. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San. Monday - Friday 745 am - 430 pm Central Time. For information on collecting and reporting local sales and use tax see 94-105 Local Sales and Use Tax Collection A Guide for Sellers.

The 78216 San Antonio Texas general sales tax rate is 825. San Antonio has parts of it located within Bexar. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

The 1675 hotel occupancy tax in San Antonio provides millions of dollars to support the convention and visitors bureau local arts history and preservation efforts maintain and. For the 10-year period through fiscal 2021 the citys general fund revenues grew by a property tax rate-adjusted CAGR of 4 equal to US. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special.

The sales tax jurisdiction. The current total local sales tax rate in San Antonio NM is 63750. San Antonio TX 78283-3966.

This includes the rates on the state county city and special levels. The current total local sales tax rate in San Antonio TX is 8250.

How To Charge Your Customers The Correct Sales Tax Rates

Texas Local Sales Taxes Part I

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Latest Property Tax Sales In Texas Mvba

Faqs City Of Rowlett Civicengage

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Texas Tax Free Shopping Weekends 2022 2022

3 4 Billion San Antonio City Budget Plan To Include Reduced Tax Rate Potential Cps Energy Customer Credits Kens5 Com

Tac School Finance The Elephant In The Property Tax Equation

Texas Sales Tax Guide For Businesses

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

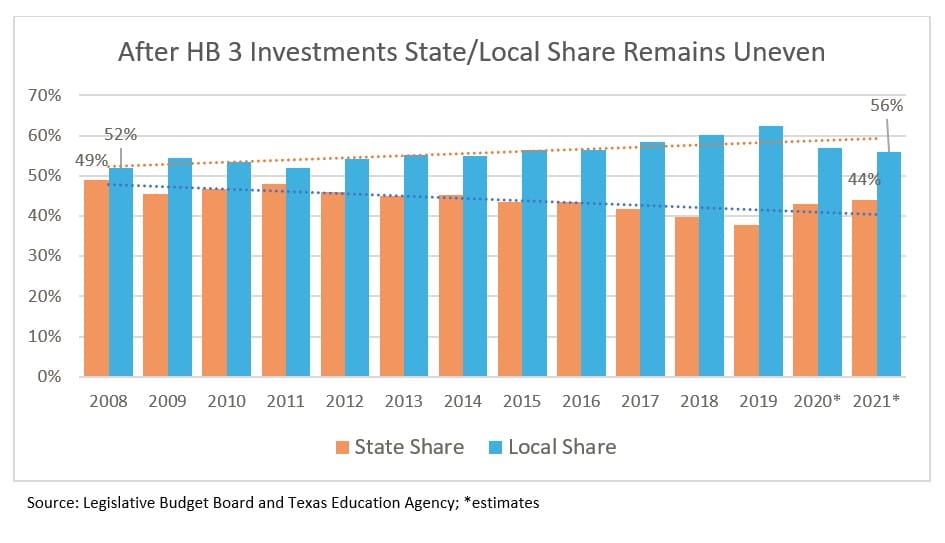

A New Division In School Finance Every Texan

How To Get Tax Refund In Usa As Tourist For Shopping 2022